The European Commission published a

summary of responses to the public consultation on bank accounts (

Taking account of banking services). The aim of the public consultation was for stakeholders to share their views on transparency of bank fees, bank account switching and access to basic payment accounts. Based on the received responses the European Commission may decide to take further action in this field.

TRANSPARENCY

Not surprisingly, the summary shows that consumers and associations representing them are in favour of further action at EU level, while the financial industry's representatives see it as abundant. However, respondents from both categories reported problems in the retail banking sector with respect to the presentation and comparability of bank account fees. (

If you can't explain it simply...)

"Almost all consumer groups reported difficulties in obtaining clear and simple information about charges and fees of bank accounts. Even with regulatory or voluntary measures, it seems problematic to understand “how relevant and useful” the information is for consumers and to ensure consumers’ financial awareness. Information is not hidden, but it is not presented in a clear way enabling consumers to make informed choices. Often, too much burden is put on consumers, who are expected to upgrade their financial knowledge. Limits of existing national measures include the disregard of vulnerable consumers’ needs.

Consumer and civil society organisations underlined the following main persisting shortcomings: complex and different business models used by banks across countries; issues linked to the offer of packaged services; varying charging structures and terminology across banks; the speed with which new and innovative products enter the market; cross-subsidisation within retail banking; and a lack of clear legislation in this area.

It was generally indicated that changes to the Payments Services Directive would not impact on these areas, given the different scope of this legal instrument."

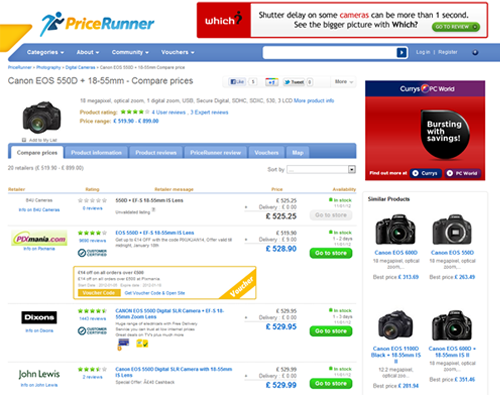

Unanimously, consumers considered it a good idea to standardise the bank account fee terminology. That would facilitate comparison of fees held by different banks as well as enable promotion of the use of simple wording. This could be achieved, e.g., by introducing a standardised glossary of all terminology and lists of bank fees. If such lists of bank fees were introduced, then consumers should not have to look further in contract documents for other fees. It may be, therefore, necessary to ban the use of other bank fees than the ones listed. In order to enable easier comparison between bank fees, consumers considered it useful to have a comparison website run by public bodies. Additionally, consumers demand a clear and timely monthly information on actual fees paid, together with a yearly overview of all costs.

SWITCHING

As far as switching bank accounts is concerned, again the representatives of consumers argued for establishing the

Common Principles of the European Bank Industry Committee (

EBIC) as mandatory (arguing that after three years from their adoption the implementation measures taken so far were poor), while the financial services industry's representatives believed they should remain voluntary. (

How to switch bank accounts remains a mystery)

"Most respondents confirmed that banks offer a switching service, but also indicated that the service provided is often insufficient or ineffective. A minority stated that the service is not offered at all and consumers need to go to the former bank to cancel mandates and then set them up on the new account. The majority commented that the switching service offered is not fully in line with the Common Principles. The most common problems concern: the availability of information on bank websites and bank branches; bank staff awareness and readiness to inform and help consumers; transfers of direct debit mandates between banks; and non-compliance with the deadlines set by the Common Principles. Some noted that the presentation of the information on switching is not user-friendly and, in general, banks do not promote switching services. Others commented that it varies from bank to bank. (...)

Among those consumers who switched, problems with direct debits and standing orders were mentioned as the biggest source of difficulty. Other problems mentioned concern: the complexity of switching; no help in informing third parties; and the length of switching, including lengthy procedures for closing an account (e.g. on average 35 days in Italy). Some noticed that the risk connected with switching is placed entirely on consumers and third parties (to whom the consumer pays). Some respondents stressed that the combination of the risk of errors with doubts over benefits is discouraging consumers from switching. The complexity and lack of transparency of the market for current accounts makes consumers unwilling or unable to make effective choices, as consumers cannot be sure that the bank they would switch to would be better or less expensive than their current bank.

Tying and bundling of products were mentioned by stakeholders as serious obstacles, making switching impossible or very expensive. Examples were given of mortgage loans granted under the condition of opening a current account or the need to close a securities account when switching a current account. Some indicated that consumers in difficulty with repayments on a loan find it difficult to switch, due to impaired credit history. Another remarked on low confidence in non-binding rules with no sanctions for banks."

All in all, consumers considered the risk of misdirected payments as the main obstacle to effective bank switching, which could be remedied by the introduction of bank account number portability (or the portability of customer account numbers). An intermediate solution, could be the introduction of a re-routing system.

ACCESS TO BASIC PAYMENT ACCOUNT

Consumers still find it difficult to access a basic payment account (see our recent post on

Basic bank account...). The most recurring obstacle is the provision of adequate proof of identity. This is required by legislation on anti-money laundering and terrorist financing. Moreover, banks refuse access to basic payment account for consumers with risky financial conditions, e.g., undischarged bankruptcy, insufficient income, poor creditworthiness, overdrawn bank accounts, etc. Additionally, some respondents indicated problems due to high costs of basic accounts, sometimes charged in the form of penalty fees. The situation is made more complicated by banks inviting consumers who ask for basic payment account to take a regular (fee-based) bank account, as well as by unavailability of branches in certain geographic areas, which burdens especially vulnerable consumers (e.g., the elderly).